Payment Method Options

Standard pricing

Lower pricing available

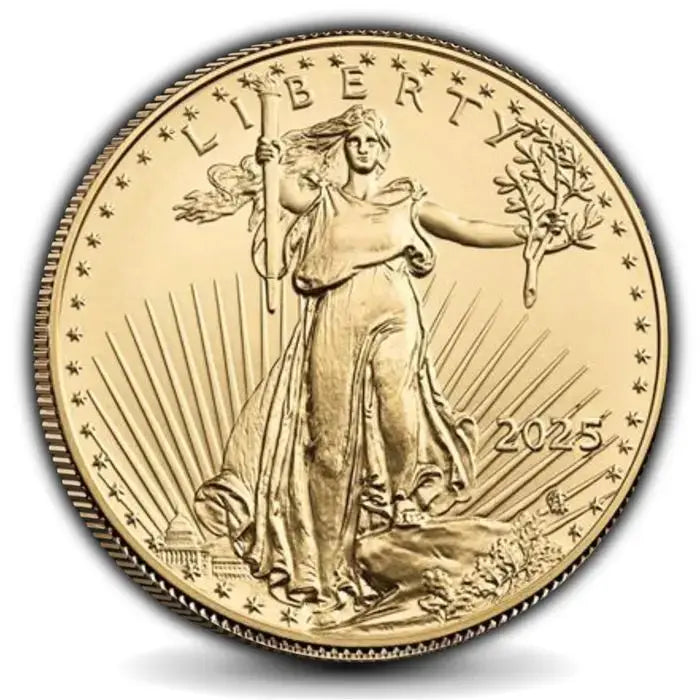

2025 1/4 oz American Gold Eagle Coin BU

2025 1/4 oz American Gold Eagle Coin BU

Your payment information is processed securely. We do not store credit card details nor have access to your credit card information.

What is a 2025 1/4 oz American Gold Eagle?

The 2025 1/4 oz American Gold Eagle is an official U.S. government gold bullion coin containing exactly one-quarter troy ounce (7.78 grams) of pure gold. Struck in a durable 22-karat alloy (91.67% gold, 3% silver, 5.33% copper), this coin carries a legal tender face value of $10 and is backed by the full faith and credit of the United States government. The quarter-ounce Gold Eagle offers an accessible entry point into physical gold ownership while maintaining the same iconic Augustus Saint-Gaudens Lady Liberty design and government guarantee as its larger counterparts. As an IRA-eligible investment, the 2025 edition features the newer eagle portrait reverse introduced in 2021 and arrives in brilliant uncirculated condition, making it equally suitable for precious metals investors and collectors seeking fractional gold coins with exceptional liquidity and worldwide recognition.

Frequently Asked Questions

Is the 1/4 oz American Gold Eagle a good investment for beginners?

Yes, the 1/4 oz American Gold Eagle is an excellent choice for beginning precious metals investors. Its lower entry cost compared to full-ounce coins makes it financially accessible while still providing meaningful gold content. The coin's official U.S. government backing ensures authenticity and purity, eliminating concerns about counterfeits that might worry new investors. Additionally, American Gold Eagles are among the most liquid gold coins globally, meaning they can be easily bought and sold through dealers nationwide. The quarter-ounce size allows beginners to start their gold accumulation journey without committing to larger denominations, making it ideal for dollar-cost averaging strategies where investors purchase regularly over time.

What makes 1/4 oz Gold Eagles different from generic gold rounds?

American Gold Eagles offer several distinct advantages over generic gold rounds. First, they carry legal tender status with a $10 face value and the full backing of the U.S. government, guaranteeing their weight, content, and purity. This official status provides universal recognition and acceptance that generic rounds cannot match. Gold Eagles also feature advanced security features and consistent quality control from the U.S. Mint, reducing authentication concerns. While generic rounds may carry lower premiums, Gold Eagles typically maintain stronger resale values and superior liquidity, especially during market volatility. The iconic Saint-Gaudens design and American heritage add collectible appeal beyond mere gold content, making these coins preferred by both investors and collectors worldwide.

How should I store my 1/4 oz American Gold Eagles?

Proper storage protects both the condition and security of your 1/4 oz Gold Eagles. For individual coins, use protective capsules specifically sized for 22mm coins to prevent scratches and handling damage. Multiple coins can be efficiently stored in specialized tubes that hold 40 quarter-ounce Gold Eagles. Store your coins in a cool, dry environment away from humidity and temperature extremes. Security options range from home safes (preferably fireproof and bolted down) to bank safe deposit boxes or professional precious metals depositories. When handling coins, hold them by the edges and consider wearing cotton gloves to prevent oils from affecting the surface. Never store gold coins in PVC-containing materials, as these can cause permanent damage over time.

Can I include 1/4 oz Gold Eagles in my retirement account?

Yes, all American Gold Eagles, including the 1/4 oz size, are explicitly approved by the IRS for inclusion in precious metals IRAs. To add these coins to your retirement account, you must work with an IRS-approved custodian specializing in self-directed precious metals IRAs. The coins must be purchased through the custodian and stored at an approved third-party depository—personal possession of IRA-held metals is prohibited by law. The quarter-ounce denomination offers particular advantages for IRAs, allowing more precise contribution amounts and greater flexibility when taking required minimum distributions. This IRA eligibility, combined with the coin's liquidity and government backing, makes 1/4 oz Gold Eagles one of the most popular choices for retirement account diversification.

What is the typical premium on 1/4 oz Gold Eagles compared to spot price?

Quarter-ounce Gold Eagles typically carry a higher percentage premium over spot gold prices compared to larger denominations, generally ranging from 5% to 12% depending on market conditions and dealer inventory. This premium structure reflects higher production costs per ounce of gold, as the U.S. Mint must strike four quarter-ounce coins to distribute the same gold content as one full ounce coin. Despite higher percentage premiums, many investors find the benefits justify the cost: enhanced liquidity, lower total investment requirements, greater flexibility for portfolio rebalancing, and accessibility for regular accumulation plans. During periods of high demand or market volatility, premiums may increase across all sizes, but fractional coins often see the largest premium spikes due to their popularity among retail investors.

| Specification | Details |

|---|---|

| Product Name | 2025 1/4 oz American Gold Eagle |

| Gold Content | 1/4 troy oz (7.78 grams) |

| Total Weight | 8.48 grams |

| Composition | 91.67% gold, 3% silver, 5.33% copper |

| Face Value | $10 USD |

| Diameter | 22.00 mm |

| Thickness | 1.78 mm |

| Edge Type | Reeded |

| Mint | United States Mint |

| IRA Eligible | Yes |

| Condition | Brilliant Uncirculated |

How 1/4 oz Gold Eagles Compare to Other Fractional Sizes

vs. 1/10 oz Gold Eagles

The 1/4 oz Gold Eagle offers superior value compared to the 1/10 oz size, with lower percentage premiums over spot gold prices. While 1/10 oz coins provide maximum divisibility and the lowest absolute cost, their premiums often exceed 15-20% over spot. The quarter-ounce strikes an optimal balance—providing meaningful gold content (2.5 times more than the 1/10 oz) while maintaining reasonable premiums and excellent liquidity. For investors building positions gradually, the 1/4 oz size allows substantial accumulation without the high premium penalty of the smallest denomination.

vs. 1/2 oz Gold Eagles

Compared to half-ounce Gold Eagles, the 1/4 oz size offers greater flexibility and accessibility at a lower total cost. While 1/2 oz coins may carry slightly lower percentage premiums, the difference is often minimal—typically just 1-2% lower. The quarter-ounce provides better granularity for portfolio management, gift-giving, and partial liquidations. Many investors prefer accumulating four quarter-ounce coins over two half-ounce coins for the enhanced flexibility, even if it means paying marginally higher premiums.

vs. 1 oz Gold Eagles

Full ounce Gold Eagles command the lowest premiums (typically 3-6% over spot) and represent the most efficient way to accumulate gold by weight. However, the 1/4 oz offers distinct advantages: a lower entry point (requiring 75% less capital), greater divisibility for partial sales, and enhanced flexibility for dollar-cost averaging. The quarter-ounce size is particularly valuable during economic uncertainty when smaller, more liquid denominations may prove advantageous for barter or emergency transactions.

Understanding 22-Karat Gold Alloy Composition

The American Gold Eagle's 22-karat composition represents a time-tested alloy standard that balances purity with durability. While some investors initially prefer 24-karat pure gold coins, the Gold Eagle's crown gold formulation (91.67% gold, 3% silver, 5.33% copper) offers significant practical advantages. This alloy increases scratch resistance and maintains the coin's lustrous appearance even with regular handling, making it ideal for coins intended for long-term storage and potential circulation. The added metals create a slightly harder surface that resists wear while preserving the warm, rich golden color that investors associate with valuable gold coins. Importantly, each 1/4 oz Gold Eagle contains exactly 0.25 troy ounces of pure gold—the alloying metals are added on top of this gold content, resulting in a total weight of 8.48 grams. This composition standard has been used for centuries in sovereign gold coins, from British Sovereigns to the original U.S. gold coins, proving its effectiveness for creating durable, beautiful, and trustworthy gold currency.

Portfolio Allocation Strategies with Fractional Gold

Fractional gold coins like the 1/4 oz American Gold Eagle play a crucial role in sophisticated precious metals allocation strategies. Financial advisors often recommend holding 5-15% of a diversified portfolio in precious metals, with gold serving as the primary allocation. The quarter-ounce denomination enables precise percentage targeting—investors can adjust their gold holdings in approximately $500-650 increments (depending on spot prices) rather than the $2,000+ jumps required with full ounces. This granularity proves especially valuable during rebalancing, allowing investors to maintain target allocations without over or under-shooting their goals. Additionally, fractional gold facilitates emergency liquidity planning. Rather than liquidating an entire ounce when cash needs arise, investors can sell only what's necessary, preserving the remainder of their position. This flexibility extends to generational wealth transfer, where equal distributions among heirs become simpler with smaller denominations.

Selling Your 2025 1/4 oz Gold American Eagle

When you're ready to liquidate your 2025 1/4 oz Gold American Eagles, Anchor Bullion offers competitive buyback pricing based on current spot prices and market conditions. Our streamlined process ensures quick evaluation and prompt payment, recognizing that liquidity is a crucial component of any investment strategy.

Our Simple Buyback Process:

- Contact for Quote: Reach out for current buyback pricing on your specific products.

- Secure Shipping: Package and ship your products to us

- Authentication: Our experts verify authenticity upon receipt

- Fast Payment: Receive payment via check or bank wire following verification

Our established relationships with refiners and wholesale networks ensure we can offer competitive prices even on small-denomination products.

Why Choose Anchor Bullion

100% Authenticity Guarantee

Every Gold Eagle sourced directly from authorized U.S. Mint distributors

Secure Shipping

Fully insured, discreet packaging with signature confirmation required

Industry Expertise

Knowledgeable specialists providing pressure-free guidance since establishment

Start Your Gold Investment Journey Today

The 2025 1/4 oz American Gold Eagle offers the perfect combination of accessibility, liquidity, and investment potential. Secure your financial future with America's most trusted gold coin.

Disclaimer: The information provided in this article is for general informational and educational purposes only and is not, and should not be construed as, investment, financial, legal, or tax advice. Anchor Bullion LLC is a precious metals dealer and is not a licensed or registered financial advisor, broker-dealer, or financial planner. All investments, including precious metals, involve risk, and the past performance of an asset is not a guarantee of future results. You should conduct your own research and consult with a qualified professional before making any investment decisions. Anchor bullion is not responsible for pricing and/or typographical errors.

- Choosing a selection results in a full page refresh.

- Opens in a new window.