Payment Method Options

Standard pricing

Lower pricing available

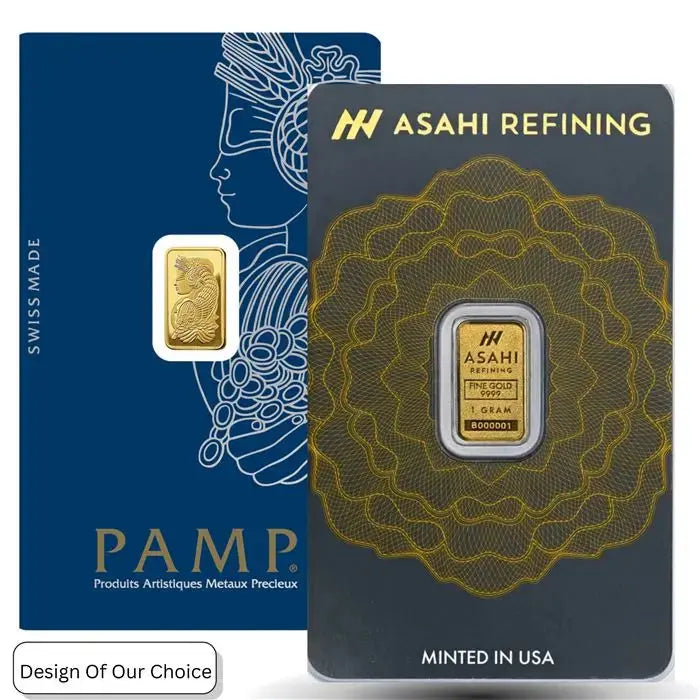

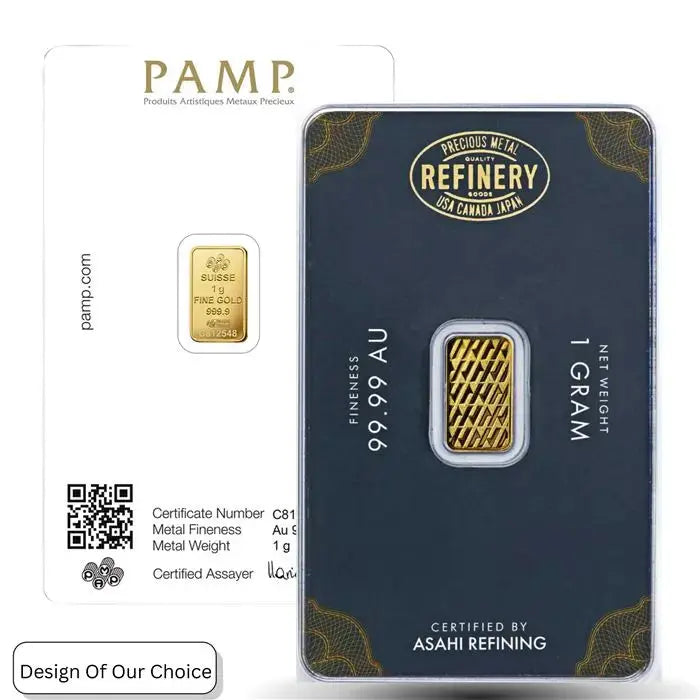

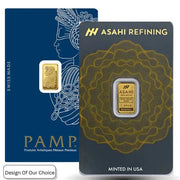

10 Gram Gold Bar – .9999 Fine Gold Design of Our Choice

10 Gram Gold Bar – .9999 Fine Gold Design of Our Choice

Your payment information is processed securely. We do not store credit card details nor have access to your credit card information.

A 10 gram gold bar contains exactly 10 grams (0.321 troy ounces) of 99.99% pure gold, representing one of the most popular fractional gold sizes for precious metals investors. These investment-grade bars are produced by globally recognized refiners like PAMP Suisse, Valcambi, Perth Mint, and Royal Canadian Mint, featuring precision minting, unique serial numbers, and sealed assay certification that guarantees weight and purity. At approximately 23mm × 14mm × 1mm, these compact bars offer an accessible entry point into physical gold ownership with lower premiums than coins while maintaining excellent liquidity and divisibility for investment portfolios.

Frequently Asked Questions About 10 Gram Gold Bars

What is the value of a 10 gram gold bar?

The value of a 10 gram gold bar consists of its intrinsic gold content plus a premium over the spot price. With 10 grams equaling 0.321 troy ounces, you calculate the base value by multiplying 0.321 by the current gold spot price. For example, at a $2,000/oz spot price, the gold content value would be approximately $642. The total purchase price includes a premium typically ranging from 3-8% above spot for bars from recognized refiners, covering manufacturing, distribution, and dealer margins. This premium is generally lower than gold coins of similar weight, making bars a cost-effective way to invest in physical gold.

Which refiners produce 10 gram gold bars?

Premium 10 gram gold bars are produced by internationally recognized refiners including PAMP Suisse (Switzerland), Valcambi (Switzerland), Royal Canadian Mint (Canada), Perth Mint (Australia), Credit Suisse (Switzerland), Argor-Heraeus (Switzerland), and Metalor (Switzerland). Each refiner brings distinctive design elements while maintaining strict quality standards of 99.99% purity. PAMP's Fortuna and Rose designs are particularly popular, while Valcambi offers sleek minimalist patterns. The Royal Canadian Mint features maple leaf motifs, and Perth Mint often includes kangaroo designs. All these refiners are LBMA-accredited, ensuring global recognition and liquidity.

Should I keep my gold bar in its assay package?

Yes, you should always keep your 10 gram gold bar in its original sealed assay package. The intact packaging serves multiple critical purposes: it preserves the bar's authentication through the matching serial numbers on both bar and certificate, protects the soft 24-karat gold surface from scratches and handling damage, maintains maximum resale value as dealers prefer unopened packages, and eliminates any authentication concerns during future sales. Opening the package can reduce the bar's value by 2-5% and may require additional verification costs when selling. Professional dealers can verify contents through the package using specialized equipment if needed.

How does a 10 gram gold bar compare to a 1/4 oz gold coin?

A 10 gram gold bar contains more gold than a 1/4 oz coin, with 10 grams equaling 0.321 troy ounces versus 0.25 troy ounces in a quarter-ounce coin—that's 28% more gold content. Gold bars typically carry lower premiums (3-8%) compared to government coins (8-15%), making them more cost-effective for pure investment purposes. However, gold coins offer legal tender status and potential numismatic value that bars lack. Bars store more efficiently with their flat, stackable design, while coins may have broader recognition among casual buyers. Both are highly liquid, but bars excel for investors prioritizing maximum gold content per dollar spent.

Can I include 10 gram gold bars in my IRA?

No, 10 gram gold bars are not eligible for inclusion in precious metals IRAs under current IRS regulations. While these bars exceed the required 99.5% purity threshold with their 99.99% fineness, they fall short of the minimum size requirement. The IRS mandates that gold bars must be at least 1 troy ounce (31.1 grams) to qualify for retirement account inclusion. If you're specifically seeking gold for an IRA, consider 1 oz gold bars, American Gold Eagles, Canadian Gold Maple Leafs, or other approved products. However, 10 gram bars remain excellent for personal investment outside retirement accounts, offering accessibility and flexibility.

10 Gram Gold Bar Specifications

| Specification | Details |

|---|---|

| Weight | 10 grams (0.321 troy ounces) |

| Purity | 99.99% fine gold (24 karat) |

| Dimensions | Approximately 23.0mm × 14.0mm × 1.0mm |

| Manufacturing | Minted (pressed) with sharp edges and details |

| Refiner | Premium refiner selected from available inventory |

| Serial Number | Unique identifier on bar and certificate |

| Assay Certificate | Included with matching serial number |

| Packaging | Sealed, tamper-evident CertiPAMP or equivalent |

| Security Features | Mint-specific anti-counterfeiting elements |

| IRA Eligible | No (minimum 1 oz required for IRAs) |

Comparing 10 Gram Gold Investment Options

10 Gram Gold Bar vs 1 Oz Gold Bar

While a 1 oz gold bar contains approximately three times more gold (31.1g vs 10g), it requires a significantly larger initial investment. The 10 gram bar offers superior divisibility for partial liquidation and typically carries only a slightly higher premium percentage over spot price. For investors building positions gradually or maintaining emergency liquidity, multiple 10 gram bars provide more flexibility than a single larger bar. The 1 oz bar becomes more efficient for substantial investments where maximum gold content per transaction is prioritized.

10 Gram Bar vs 10 Gram Gold Coin

Government-minted 10 gram gold coins like the Chinese Panda or Australian Lunar series command significantly higher premiums (15-25%) compared to bars (3-8%) due to limited mintages and collectible appeal. While coins offer legal tender status and numismatic potential, bars provide more gold for your investment dollar. The bar's rectangular shape also stores more efficiently than round coins. Choose bars for pure bullion investment and coins when seeking collectibility alongside gold content.

Premium Minted vs Generic Cast Bars

Premium minted 10 gram bars from recognized refiners feature superior finish quality, precise dimensions, comprehensive security features, and sealed assay packaging that generic cast bars lack. While generic bars may cost slightly less, they often require additional authentication when selling and may face liquidity challenges. The modest premium difference (typically 1-3%) for recognized brands is justified by guaranteed authenticity, easier resale, and professional presentation that maintains long-term value.

Investment Strategy Benefits

The 10 gram gold bar format offers unique strategic advantages for modern precious metals portfolios. This size enables dollar-cost averaging strategies where investors accumulate gold systematically over time, smoothing out price volatility while building substantial holdings. The fractional size makes gold investment accessible to younger investors or those with limited discretionary income who might be priced out of larger formats. For emergency preparedness, these bars provide optimal liquidity—large enough to represent meaningful value while small enough to exchange without requiring change. Many investors use 10 gram bars as a portfolio complement to larger holdings, creating a barbell strategy with bulk positions in larger bars for long-term wealth preservation and smaller bars for flexibility and potential near-term needs.

Authentication and Security Features

Modern 10 gram gold bars incorporate sophisticated security elements that protect against counterfeiting while ensuring straightforward authentication. Each bar's unique serial number is laser-etched or stamped and matched to its accompanying assay certificate, creating an unbreakable chain of verification. Premium refiners employ proprietary security features including micro-engraving visible only under magnification, holographic elements that shift appearance when viewed from different angles, and specialized surface textures that are difficult to replicate. The sealed packaging itself serves as a security layer, with tamper-evident materials that show clear signs of interference. Advanced mints like PAMP Suisse utilize their Veriscan technology, allowing instant authentication through surface recognition scanning. These overlapping security measures ensure that your investment maintains its integrity and value throughout its lifetime, providing confidence for both current ownership and eventual resale.

Evolution of 10 Gram Gold Bar Standards

Introduction of metric weight gold bars as international markets standardized measurements beyond traditional troy ounce system.

Swiss refiners pioneered sealed assay card packaging, revolutionizing authentication and establishing today's security standards.

Implementation of laser-etching technology enabled unique serial numbering on small bars with unprecedented precision.

Advanced anti-counterfeiting features including holograms and micro-text became standard among premium refiners.

Digital verification systems and blockchain documentation emerged, enhancing traditional physical security measures.

Direct From Authorized Distributors

Every bar sourced through official channels with documented chain of custody

Fully Insured Shipping

Discrete, secure delivery with complete insurance coverage and tracking

Authentication Guaranteed

100% genuine products verified through multiple quality control checkpoints

Disclaimer: The information provided in this article is for general informational and educational purposes only and is not, and should not be construed as, investment, financial, legal, or tax advice. Anchor Bullion LLC is a precious metals dealer and is not a licensed or registered financial advisor, broker-dealer, or financial planner. All investments, including precious metals, involve risk, and the past performance of an asset is not a guarantee of future results. You should conduct your own research and consult with a qualified professional before making any investment decisions. Anchor bullion is not responsible for pricing and/or typographical errors.

- Choosing a selection results in a full page refresh.

- Opens in a new window.