Payment Method Options

Standard pricing

Lower pricing available

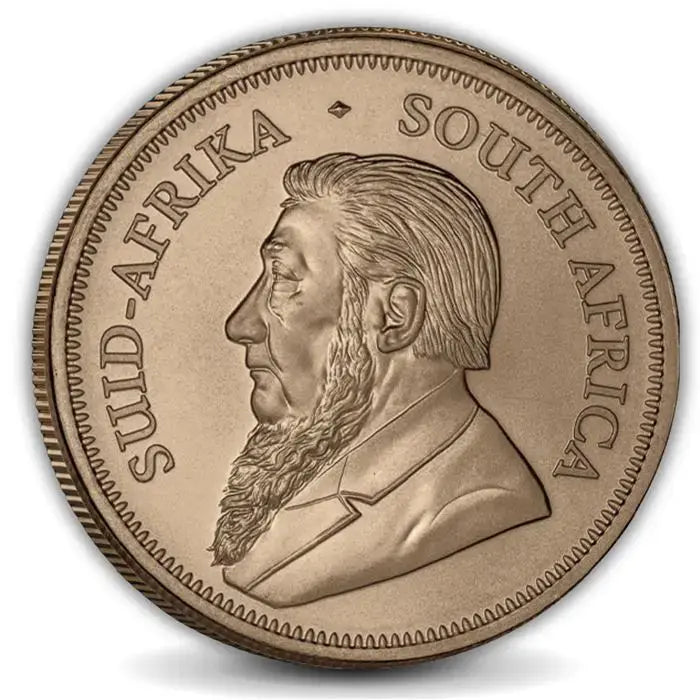

1 oz South African Gold Krugerrand Random Year

1 oz South African Gold Krugerrand Random Year

Your payment information is processed securely. We do not store credit card details nor have access to your credit card information.

What is a 1 oz South African Gold Krugerrand?

The 1 oz South African Gold Krugerrand is the world's first modern gold bullion coin, containing exactly one troy ounce of pure gold in a durable 22-karat alloy. Introduced in 1967 by the South African Mint, the Krugerrand revolutionized gold investing by creating the first coin specifically designed for private investors to own physical gold. Each coin features the iconic portrait of Paul Kruger, South Africa's first president, on the obverse and the national springbok antelope on the reverse. With its distinctive rose-gold color from the copper alloy and over 50 million ounces minted to date, the Krugerrand remains the most recognized and traded gold bullion coin globally, offering exceptional liquidity and value for precious metals investors.

Frequently Asked Questions About Gold Krugerrands

A 1 oz South African Gold Krugerrand contains exactly one troy ounce (31.1035 grams) of pure gold. While the coin's total weight is 33.93 grams, this includes the copper alloy that gives the coin its 22-karat composition (91.67% gold, 8.33% copper). This precise gold content is guaranteed by the South African government and remains consistent across all years of production since 1967. The additional copper creates the coin's distinctive rose-gold color and enhanced durability compared to pure 24-karat gold coins.

Gold Krugerrands are considered excellent investment vehicles for several reasons. As the world's most recognized gold bullion coin with over 50 million ounces in circulation, they offer exceptional liquidity in global markets. Random year Krugerrands typically trade at lower premiums over spot price compared to newer coins, maximizing gold content per dollar invested. Their 22-karat composition provides superior durability for long-term storage, while their IRA eligibility allows for tax-advantaged retirement investing. The combination of government backing, worldwide recognition, and proven track record through multiple economic cycles makes Krugerrands a cornerstone holding for many precious metals portfolios.

The primary difference lies in purity and durability. 22-karat gold coins like Krugerrands contain 91.67% pure gold alloyed with copper, creating a harder, more scratch-resistant coin with a distinctive rose-gold hue. 24-karat coins contain 99.9% pure gold but are softer and more prone to damage from handling. Both types contain the same amount of pure gold per stated weight - a 1 oz Krugerrand and a 1 oz Maple Leaf each contain exactly one troy ounce of pure gold. The Krugerrand simply weighs more overall (33.93g vs 31.1g) due to the copper content, offering enhanced durability without compromising gold value.

Yes, South African Gold Krugerrands are fully eligible for inclusion in precious metals IRAs. Despite being 22-karat rather than 24-karat, they meet IRS purity requirements for gold coins in self-directed retirement accounts. To add Krugerrands to your IRA, you must work with an approved precious metals custodian who will arrange for the coins to be stored at an IRS-approved depository. Personal possession of IRA metals is prohibited by tax regulations. Many investors choose Krugerrands for their IRAs due to lower premiums, allowing acquisition of more gold ounces within annual contribution limits while maintaining the security of government-backed bullion.

Unlike most government bullion coins that carry nominal face values (American Eagles at $50, Canadian Maple Leafs at $50 CAD), Krugerrands were designed without any denominational marking. This reflects their intended purpose as pure bullion investments valued solely by gold content rather than as legal tender currency. The absence of face value actually benefits investors by eliminating any confusion about the coin's worth - a Krugerrand's value directly tracks the price of one ounce of gold plus market premium. This straightforward approach pioneered by South Africa in 1967 emphasized the Krugerrand's role as the world's first true investment-grade gold bullion coin.

| Specification | Details |

|---|---|

| Year of Issue | Random (1967 to previous years) |

| Gold Content | 1 troy oz (31.1035 grams) |

| Purity | 91.67% gold (22 karat) |

| Total Weight | 33.93 grams |

| Composition | 91.67% gold, 8.33% copper |

| Diameter | 32.77 mm |

| Thickness | 2.84 mm |

| Edge Type | Serrated (reeded) |

| Face Value | None (valued by gold content) |

| Mint | South African Mint |

| Condition | Brilliant Uncirculated |

| IRA Eligible | Yes |

How Gold Krugerrands Compare to Other 1 oz Gold Coins

Krugerrand vs American Gold Eagle

Both coins share the same 22-karat composition and contain exactly one troy ounce of pure gold. The American Eagle carries a $50 face value and features Liberty on the obverse, while the Krugerrand has no face value and displays Paul Kruger. Eagles typically command higher premiums due to their popularity in the US market. However, Krugerrands offer superior global liquidity with wider international recognition, having been available since 1967 compared to the Eagle's 1986 introduction. For cost-conscious investors, random year Krugerrands generally provide the same gold content at significantly lower premiums.

Krugerrand vs Canadian Gold Maple Leaf

The primary distinction lies in purity and durability. Maple Leafs contain 99.99% pure gold (24-karat) with a bright yellow appearance, while Krugerrands use 91.67% gold alloyed with copper for a rose-gold hue and enhanced scratch resistance. Both contain exactly one ounce of pure gold, but the Krugerrand weighs 33.93 grams total versus the Maple Leaf's 31.1 grams. Maple Leafs feature advanced security features like radial lines and micro-engraving, while Krugerrands rely on their distinctive appearance and long market history for authentication. The harder Krugerrand alloy makes them ideal for investors who may handle their coins frequently.

Krugerrand vs Austrian Gold Philharmonic

The Austrian Philharmonic, first minted in 1989, contains 99.99% pure gold like the Maple Leaf, contrasting with the Krugerrand's 22-karat alloy. Both are legal tender in their respective countries, though the Philharmonic carries a €100 face value while the Krugerrand has none. The Philharmonic's musical instrument design appeals to European markets, while the Krugerrand's springbok and historical significance resonate globally. In terms of market liquidity, Krugerrands maintain an advantage with over 50 million ounces in circulation versus the Philharmonic's more limited distribution, typically resulting in easier buying and selling worldwide.

The Historical Significance of Gold Krugerrands in Modern Precious Metals Markets

The South African Gold Krugerrand fundamentally transformed how individuals invest in physical gold when it debuted in 1967. Before its introduction, private gold ownership options were limited to old circulation coins trading at high numismatic premiums or commercial bars unsuitable for smaller investments. The Krugerrand pioneered the concept of a bullion coin valued primarily for its metal content rather than face value, creating an entirely new market segment. This innovation coincided with rising inflation concerns globally and the eventual abandonment of the gold standard, positioning the Krugerrand perfectly as nations lifted restrictions on private gold ownership. By the early 1980s, Krugerrands commanded an astounding 90% market share of the global gold coin market, establishing the template that every subsequent national bullion program would follow.

Understanding Random Year Krugerrand Investment Strategy

Random year Gold Krugerrands represent an intelligent approach to physical gold accumulation for cost-conscious investors. By accepting coins from various years rather than insisting on current production, investors typically save significant premiums while receiving identical gold content and government backing. These coins undergo the same quality verification as dated issues, ensuring brilliant uncirculated condition without damage or excessive handling. The strategy particularly benefits those building larger positions through dollar-cost averaging, as the premium savings compound over multiple purchases. Additionally, random year coins occasionally include issues from historically significant periods or lower mintage years that may develop modest collector interest over time, providing potential upside beyond the intrinsic gold value.

Anchor Bullion Buyback Program

Competitive Rates

When you're ready to liquidate your 1 oz Gold Krugerrands, Anchor Bullion offers competitive buyback pricing based on current spot prices and market conditions.

Our Simple Buyback Process

Our streamlined process ensures quick evaluation and prompt payment, recognizing that liquidity is a crucial component of any investment strategy. Reach out for current buyback pricing on your specific products.

Secure Shipping

Package and ship your products to us. Our experts verify authenticity upon receipt, and payment can be made via check or bank wire following verification.

When you're ready to sell your 1 oz Gold Krugerrands, we're ready to buy. Our established buyback program ensures you have a reliable exit strategy for your investment.

Why Choose Anchor Bullion for Your Krugerrand Purchase

100% Authenticity Guarantee

Every coin verified through multiple authentication methods with decades of industry expertise

Secure Insured Shipping

Fully insured delivery with discreet packaging and real-time tracking to your door

Industry Expertise

Knowledgeable specialists providing education-first guidance without high-pressure sales tactics

Add Gold Krugerrands to Your Portfolio Today

Our random year Krugerrands offer exceptional value with guaranteed authenticity and secure delivery.

Disclaimer: The information provided in this article is for general informational and educational purposes only and is not, and should not be construed as, investment, financial, legal, or tax advice. Anchor Bullion LLC is a precious metals dealer and is not a licensed or registered financial advisor, broker-dealer, or financial planner. All investments, including precious metals, involve risk, and the past performance of an asset is not a guarantee of future results. You should conduct your own research and consult with a qualified professional before making any investment decisions. Anchor bullion is not responsible for pricing and/or typographical errors.

- Choosing a selection results in a full page refresh.

- Opens in a new window.