Payment Method Options

Standard pricing

Lower pricing available

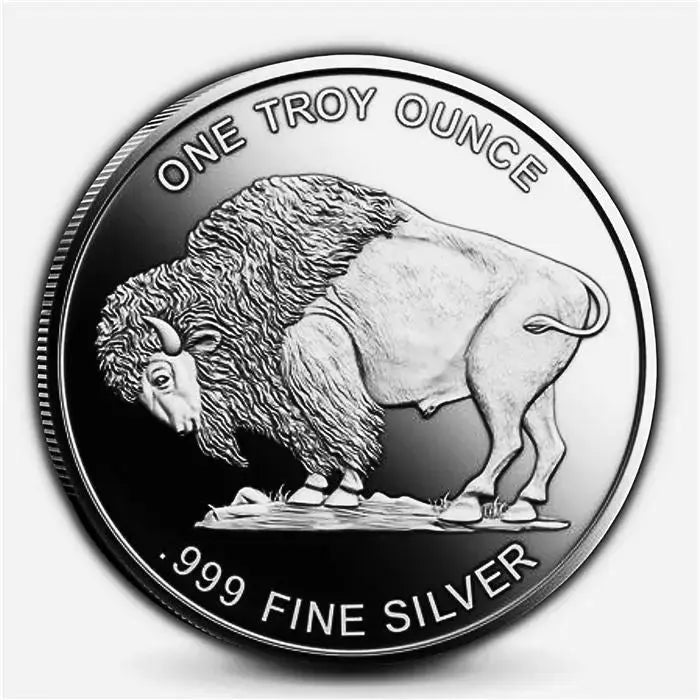

1 oz Silver Round - Random Design .999 Fine

1 oz Silver Round - Random Design .999 Fine

Your payment information is processed securely. We do not store credit card details nor have access to your credit card information.

Why Smart Investors Choose 1 oz Silver Rounds for Portfolio Diversification

The 1 oz Silver Round delivers pure .999 fine silver at the lowest possible premium over spot price, making it the most cost-effective way to accumulate physical silver bullion for serious investors. Unlike government-minted coins that carry $3-8 premiums, silver rounds typically trade just $1-3 above spot, allowing investors to maximize their silver ounces per dollar invested. With industrial silver demand projected to exceed 700 million ounces annually and supply deficits persisting for the fifth consecutive year, silver rounds offer direct exposure to silver's fundamental value without paying extra for numismatic features—perfect for investors focused on accumulating maximum physical silver weight.

Frequently Asked Questions About Silver Rounds

What is the current price of 1 oz silver rounds?

Silver rounds typically trade $1-3 above the current spot price of silver, which fluctuates throughout the trading day based on global precious metals markets. With spot silver averaging $24-26 per ounce in recent months, expect to pay $25-29 per round depending on quantity purchased and current market premiums. Bulk purchases of 20+ rounds often qualify for lower premiums, while single rounds carry slightly higher markups to cover processing costs.

Are 1 oz silver rounds a good investment?

Silver rounds offer exceptional value for investors seeking maximum silver weight per dollar, with industrial demand driving a structural supply deficit exceeding 215 million ounces annually. Unlike numismatic coins, rounds provide pure silver exposure without collectible premiums, making them ideal for stacking physical metal. The combination of growing solar panel demand, electric vehicle adoption, and declining mine production creates compelling fundamentals for silver appreciation over the coming decade.

What's the difference between silver rounds and silver coins?

Silver coins are legal tender minted by government facilities with face values and sovereign backing, while silver rounds are produced by private mints without monetary denomination. Coins like American Silver Eagles command $3-8 premiums due to government guarantee and collectibility, whereas rounds trade closer to spot price at $1-3 premiums. Both contain the same .999 fine silver purity, but rounds offer more silver ounces per dollar invested for stackers prioritizing weight over numismatic value.

How do I store silver rounds safely?

Store silver rounds in protective tubes or capsules within a climate-controlled environment maintaining 65-70°F with humidity below 50% to prevent tarnishing. Home safes should be fireproof-rated for at least 1 hour and bolted to concrete floors, while bank safety deposit boxes offer offsite security for $30-100 annually. Professional vault storage through depositories like Brinks or Delaware Depository provides segregated storage with full insurance at approximately 0.5-1% of value per year.

Can I add silver rounds to my IRA?

Yes, silver rounds meeting the IRS minimum fineness requirement of .999 purity are eligible for precious metals IRAs under Section 408(m). Work with approved IRA custodians like Equity Trust or Kingdom Trust to purchase rounds and arrange storage at IRS-approved depositories. The rounds must remain in professional vault storage to maintain IRA compliance, offering tax-advantaged silver accumulation within retirement accounts while diversifying beyond traditional paper assets.

Are silver rounds real silver?

Yes, investment-grade silver rounds contain .999 fine silver (99.9% pure), matching the purity of government-minted bullion coins. Reputable private mints like Sunshine Minting, SilverTowne, and Highland Mint produce rounds meeting industry standards with precise 1 troy ounce weights. Authentic rounds pass magnet tests (silver is non-magnetic), ping tests producing distinctive high-pitched tones, and specific gravity measurements confirming genuine silver content.

| Specification | Details |

|---|---|

| Product Type | Generic Silver Bullion Round |

| Weight | 1 Troy Ounce (31.1035 grams) |

| Purity | .999 Fine Silver (99.9% pure) |

| Diameter | 39mm (1.54 inches) typical |

| Thickness | 2.7-3.0mm average |

| Face Value | None (not legal tender) |

| Mint Source | Various Private Mints |

| Design Type | Random - Dealer's Choice |

| IRA Eligible | Yes - Meets .999 requirement |

| Premium Range | $1-3 over spot price |

| Minimum Order | 1 round |

| Bulk Discount | Available at 20+ rounds |

| Storage Options | Tubes hold 20 rounds |

| Liquidity | High - Accepted globally |

| Best For | Stack building, weight accumulation |

How Silver Rounds Compare to Other Silver Investment Options

Silver Rounds vs. Silver Eagles

Silver rounds offer 20-30% more ounces per dollar compared to American Silver Eagles, with typical savings of $3-5 per ounce in lower premiums. While Eagles provide government backing and superior liquidity, rounds deliver maximum silver weight for investors focused on accumulation over collectibility. For a $10,000 investment, choose rounds to acquire 400 ounces versus 350 ounces of Eagles, gaining 50 additional ounces of pure silver through premium savings alone.

Silver Rounds vs. Silver Bars

One-ounce silver rounds provide superior divisibility compared to larger bars, enabling partial sales without breaking up larger units. While 10-100 oz bars offer slightly lower premiums per ounce, rounds maintain better liquidity through universal recognition and standardized sizing. The ability to sell individual ounces makes rounds ideal for dollar-cost averaging strategies and emergency liquidity needs that large bars cannot efficiently accommodate.

Silver Rounds vs. Junk Silver

Modern silver rounds contain exactly 1 troy ounce of .999 fine silver versus pre-1965 coins containing 90% silver requiring calculations for actual silver content. Rounds offer precise weight measurements and pristine condition compared to worn constitutional silver trading at varying premiums based on condition. While junk silver provides fractional denominations and survival currency potential, rounds deliver straightforward silver investment without numismatic complexity.

Understanding Silver Market Fundamentals and Round Investment Timing

The global silver market faces unprecedented supply-demand imbalances with industrial consumption reaching 700 million ounces annually while mine production stagnates at 830 million ounces, creating persistent deficits exceeding 215 million ounces. Solar panel manufacturing alone consumes 20% of annual silver production, with each gigawatt of solar capacity requiring 20 metric tons of silver. Electric vehicles utilize 25-50 grams per unit across electrical contacts, while 5G infrastructure deployment accelerates silver demand in telecommunications equipment. Silver rounds provide direct exposure to these fundamental drivers without numismatic premiums, allowing investors to accumulate maximum ounces as industrial users compete for declining available supplies against investment demand averaging 280 million ounces yearly.

Private Mint Quality Standards and Round Authentication Methods

Leading private mints including Sunshine Minting, SilverTowne, Highland Mint, and Asahi Refining maintain rigorous quality standards producing .999 fine silver rounds meeting London Bullion Market Association specifications. Advanced minting technology ensures precise weights within 0.1% tolerance using computer-controlled presses striking at 150 tons of pressure. Authentication methods include magnetic slide tests confirming silver's paramagnetic properties, ice melt tests demonstrating silver's superior thermal conductivity, and specific gravity measurements of 10.49 confirming genuine silver density. Professional dealers employ Sigma Metalytics analyzers verifying electromagnetic signatures through non-destructive testing, while mint security features like Sunshine's MintMark SI™ provide decoder lens verification.

Silver Round Buyback Programs and Liquidity Advantages

Silver rounds maintain exceptional liquidity through universal acceptance at precious metals dealers worldwide, with competitive buyback prices typically $0.50-1.50 below spot price. The standardized 1-ounce weight and .999 purity ensures immediate recognition without authentication delays common with unusual formats. Anchor Bullion's guaranteed buyback program offers transparent pricing updated every 60 seconds during market hours, with same-day payment via ACH or wire transfer for verified rounds. The generic nature of silver rounds eliminates collectible premium volatility, providing predictable liquidity based purely on silver content value.

Why Buy Silver Rounds from Anchor Bullion

100% Authenticity Guarantee

Every round verified through Sigma Metalytics testing and visual inspection before shipping

Free Shipping Over $199

Fully insured USPS or UPS delivery with signature confirmation on all orders

Lowest Price Guarantee

Competitive pricing with bulk discounts starting at 20 rounds

Fast Shipping

Orders ship within 1-2 business days of payment clearing

Explore Related Silver Products

Start Building Your Silver Stack Today

Lock in today's prices on 1 oz silver rounds - the smart way to accumulate physical silver.

Buy Silver Rounds NowDisclaimer: The information provided is for educational purposes only and should not be considered investment advice. Precious metals investments carry risk and past performance does not guarantee future results. Silver rounds are not legal tender and their value fluctuates with market conditions. Anchor Bullion LLC is a precious metals dealer, not a licensed financial advisor. Consult qualified professionals before making investment decisions. Prices subject to change based on market conditions.