Payment Method Options

Standard pricing

Lower pricing available

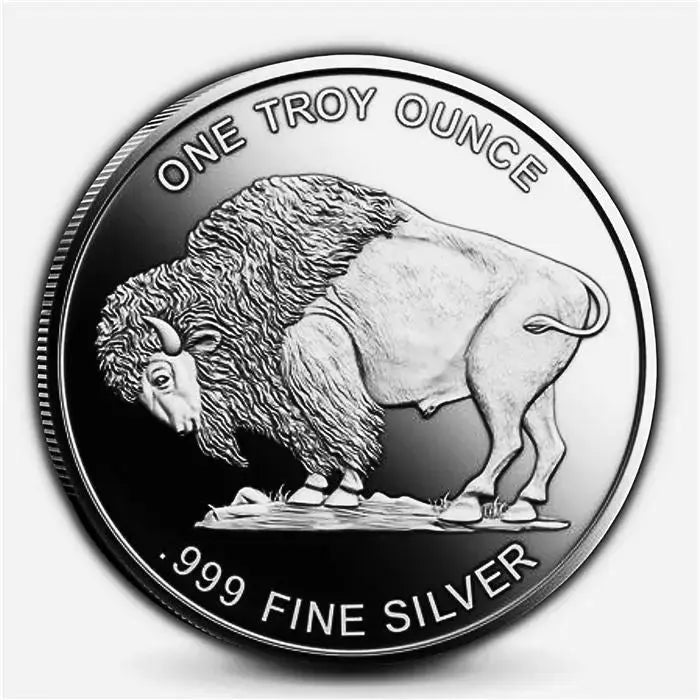

1 oz Silver Round - Random Design .999 Fine

1 oz Silver Round - Random Design .999 Fine

Your payment information is processed securely. We do not store credit card details nor have access to your credit card information.

Why Smart Investors Choose 1 oz Silver Rounds for Maximum Value

The 1 oz Silver Round delivers unmatched value in precious metals investing, offering the lowest premiums over spot price while maintaining .999 fine silver purity that qualifies for precious metals IRAs. With silver surging 40% in 2025 to over $40 per ounce and industrial demand exceeding 700 million ounces annually, these investment-grade rounds provide immediate cost savings of $2-4 per ounce compared to government coins—allowing investors to acquire 10-20% more physical silver for the same investment. As the silver market faces its fifth consecutive year of supply deficits totaling 180+ million ounces, these rounds offer both portfolio protection and growth potential, backed by renowned private mints including Sunshine Minting, SilverTowne, Highland Mint, and Asahi Refining.

Frequently Asked Questions About 1 oz Silver Rounds

What is the current price of 1 oz silver rounds?

With silver spot price at $40.74 per ounce as of September 2025, 1 oz silver rounds typically trade at $42.74-44.74 including premiums of $2-4 over spot. This represents the best value in the silver market, as government coins like American Silver Eagles carry premiums of $5-8. Prices fluctuate throughout the trading day based on global precious metals markets, with the lowest premiums often available for bulk purchases of 20+ rounds.

Is a 1 oz silver round a good investment?

Silver rounds offer compelling investment potential with 40% gains year-to-date in 2025 and structural supply deficits exceeding 180 million ounces annually. Industrial demand from solar panels (200+ million oz/year) and electric vehicles ensures long-term consumption growth. The current gold-to-silver ratio of 87:1 sits well above the historical average of 60:1, suggesting significant undervaluation. Major banks project silver reaching $46-56 per ounce by year-end, with technical breakouts targeting $70.

What's the difference between silver rounds and silver coins?

Silver rounds are produced by private mints without legal tender status, while silver coins are government-minted with face values. This distinction allows rounds to carry lower premiums—typically $2-4 over spot versus $5-8 for American Silver Eagles. Both contain identical silver purity (.999 fine or higher) and weight (1 troy ounce), making rounds the more cost-effective choice for investors prioritizing silver content over collectibility. Rounds also offer greater design variety from multiple private mints.

How do I store silver rounds safely?

Store silver rounds in environments below 50% humidity at 60-70°F using airtight containers or anti-tarnish bags with Pacific Silvercloth®. Mint tubes hold 20 rounds efficiently, while Air-Tite capsules protect individual pieces. Home safes weighing 300+ pounds provide security for moderate holdings. For larger investments, professional depositories like Delaware Depository offer climate-controlled storage with full insurance at approximately 0.5% annual fees. Never store silver in bank safe deposit boxes during economic uncertainty.

Can I add silver rounds to my IRA?

Yes, all 1 oz silver rounds meeting the IRS minimum fineness of .999 qualify for precious metals IRAs under IRC Section 408(m)(3). Our rounds from approved refiners exceed this standard. Work with an approved custodian to facilitate purchase and arrange storage at IRS-approved depositories. The low premiums on silver rounds make them particularly attractive for IRA investors seeking to maximize retirement contribution purchasing power while maintaining tax-advantaged growth.

How can I verify silver rounds are authentic?

Authenticate silver rounds through multiple methods: precision scales confirming 31.103 gram weight, calipers verifying 39mm diameter, neodymium magnet tests exploiting silver's diamagnetic properties, and the distinctive high-pitched "ring" when struck. Professional Sigma Metalytics testing provides electromagnetic verification without damaging rounds. Sunshine Minting rounds feature MintMark SI technology requiring special decoder lenses. Reputable dealers like Anchor Bullion guarantee authenticity with buy-back provisions.

| Specification | Details |

|---|---|

| Product Type | Investment Silver Round |

| Weight | 1 Troy Ounce (31.1035 grams) |

| Purity | .999 Fine Silver Minimum (99.9%) |

| Diameter | 39mm standard |

| Thickness | 2.9-3.2mm |

| Current Premium Range | $2.00 - $4.00 per ounce over spot |

| Manufacturers | Sunshine, SilverTowne, Highland, Asahi, Others |

| Design Selection | Random from current inventory |

| Common Designs | Buffalo, Walking Liberty, Morgan, Eagles |

| Security Features | MintMark SI (select manufacturers) |

| IRA Eligible | Yes - Meets IRS Requirements |

| Storage | Tubes of 20 or individual flips |

| Liquidity | Excellent - Globally recognized |

| Investment Minimum | 1 Round ($42-45 at current prices) |

| Bulk Discounts | Available at 20+ rounds |

How 1 oz Silver Rounds Compare to Other Silver Investments

Silver Rounds vs. American Silver Eagles

Silver rounds deliver exceptional value with premiums of $2-4 per ounce compared to $5-8 for Silver Eagles—saving investors $3-4 per ounce or $60-80 per tube of 20. Both contain identical 1 troy ounce of .999 fine silver, making rounds 10-20% more cost-effective for accumulating physical silver. Eagles offer government backing and potentially higher resale recognition, but for investors prioritizing maximum silver content per dollar invested, rounds provide superior value. The premium savings compound significantly when building substantial positions through dollar-cost averaging.

Silver Rounds vs. Silver Bars

While 10 oz and 100 oz bars offer slightly lower per-ounce premiums, 1 oz rounds provide superior flexibility for partial sales and gifting. Rounds allow investors to liquidate precise amounts without selling entire large bars. The standardized 39mm size fits perfectly in Air-Tite capsules and storage tubes, simplifying organization. For new investors or those with budgets under $5,000, rounds offer the ideal entry point with minimum purchases as low as $42-45. Combine rounds for flexibility with larger bars for core holdings.

Silver Rounds vs. Junk Silver Coins

Pre-1965 U.S. coins contain 90% silver versus 99.9% purity in modern rounds, requiring calculations to determine actual silver content. While junk silver offers divisibility for barter scenarios, rounds provide cleaner accounting with exactly 1 troy ounce per piece. Rounds also avoid the wear issues common in circulated coins that reduce silver content 1-3%. For IRA eligibility, rounds meet the .999 fineness requirement while junk silver does not qualify. Modern rounds represent the evolution of silver investing with improved purity and standardization.

Understanding the 2025 Silver Supply Crisis and Investment Implications

The global silver market faces unprecedented strain with industrial consumption reaching 700+ million ounces annually while mine production remains stagnant at 830 million ounces. Solar panel manufacturing alone consumes 20% of global supply, with each gigawatt of capacity requiring 70 metric tons of silver. Electric vehicles use 25-50 grams per unit, while emerging 5G infrastructure and AI data centers create entirely new demand categories. The Silver Institute projects deficits exceeding 180 million ounces in 2025—the fifth consecutive year of shortfalls. This structural imbalance historically precedes significant price movements, as seen in 1979-1980 when similar conditions drove silver from $6 to $50. With above-ground inventories declining and industrial users competing directly with investors for limited supply, physical ownership through 1 oz silver rounds positions investors ahead of potential supply squeezes.

Premium Mints and Manufacturing Excellence

Our random design silver rounds originate exclusively from accredited private mints meeting rigorous quality standards. Sunshine Minting, operating since 1979, produces planchets for the U.S. Mint and features proprietary MintMark SI security technology. SilverTowne's 70-year heritage includes ISO 9001:2015 certification and custom designs collectors prize. Highland Mint supplies officially licensed sports commemoratives alongside investment rounds. Asahi Refining, having acquired Johnson Matthey's operations, continues the legacy with LBMA certification. Each mint employs computer-controlled striking pressures, continuous assay testing, and precise weight calibration to ±0.001 ounces. These standards ensure your rounds maintain maximum liquidity globally, with instant recognition from dealers worldwide eliminating costly authentication delays.

Silver Round Buyback Program and Market Liquidity

The true test of any precious metals investment comes at selling time, and 1 oz silver rounds excel in market liquidity. Generic rounds trade at consistent spreads of $4-6 between dealer buy and sell prices, with Buffalo designs and major brand rounds commanding the best recognition. Major dealers including Anchor Bullion, maintain standing buy orders for unlimited quantities of 1 oz rounds. Local coin shops readily purchase them based on silver content regardless of design. During supply crunches, industrial users often pay premium prices for immediate delivery. This superior liquidity stems from standardized specifications that simplify handling and the universal acceptance of 1 troy ounce as the global trading standard for physical silver.

Why Choose Anchor Bullion for Your Silver Round Investment

Authentication Guarantee

Every round undergoes multi-point verification including weight, dimension, and Sigma Metalytics electromagnetic testing

Discrete Secure Shipping

USPS Registered Mail or UPS with full insurance, signature required, plain packaging for privacy protection

Lowest Premium Guarantee

Direct mint relationships enable industry-leading pricing with bulk discounts starting at 20 rounds

Buyback Program

We purchase all rounds we sell at competitive rates with transparent pricing posted daily

Secure Your Wealth with 1 oz Silver Rounds Today

Lock in today's low premiums while silver faces historic supply deficits.

Disclaimer: The information provided is for educational purposes only and should not be considered investment, financial, legal, or tax advice. Anchor Bullion LLC is a precious metals dealer, not a licensed financial advisor or broker-dealer. Precious metals investments involve risk, and past performance does not guarantee future results. Conduct your own research and consult qualified professionals before making investment decisions. Current prices subject to change. Anchor Bullion is not responsible for pricing errors or typographical mistakes.