Payment Method Options

Standard pricing

Lower pricing available

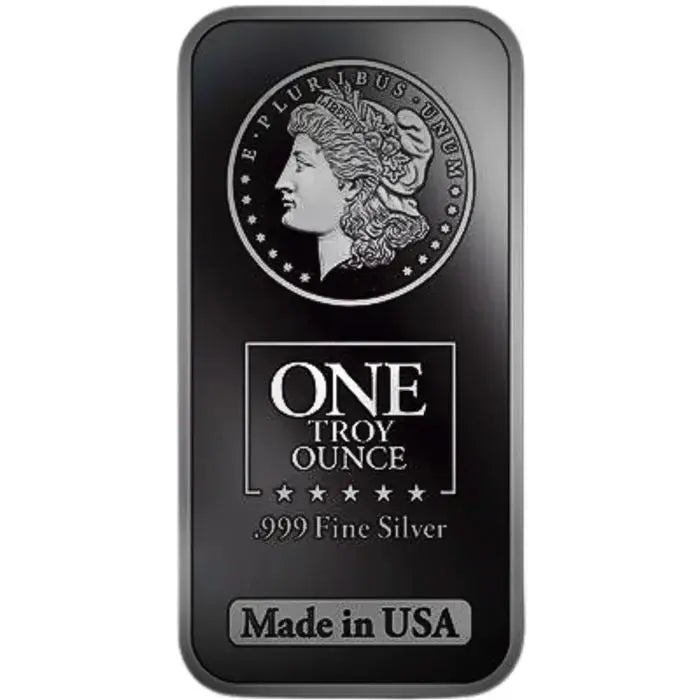

1 oz Morgan Silver Bar .999 Fine

1 oz Morgan Silver Bar .999 Fine

Your payment information is processed securely. We do not store credit card details nor have access to your credit card information.

What Is a 1 oz Morgan Silver Bar?

A 1 oz Morgan Silver Bar is a premium bullion product containing exactly one troy ounce of .999 fine silver (99.9% pure) that features the iconic design of the historic Morgan Dollar. These investment-grade silver bars are produced by respected private mints including Golden State Mint, Highland Mint, and Silvertowne, offering collectors and investors a cost-effective way to own pure silver with lower premiums than government-issued coins. Each bar measures approximately 50mm x 29mm x 2.3mm and comes in Brilliant Uncirculated condition, making them ideal for both precious metals IRAs and private silver stacking.

Frequently Asked Questions About Morgan Silver Bars

Are Morgan Silver Bars real Morgan Dollars?

No, Morgan Silver Bars are not actual Morgan Dollars. They are modern bullion bars that feature a design inspired by the classic Morgan Dollar coin that was minted from 1878 to 1921. These bars are produced by private mints and contain one troy ounce of .999 fine silver, whereas original Morgan Dollars were 90% silver and weighed 26.73 grams. The bars pay homage to the iconic Lady Liberty design but are purely investment-grade bullion products without any numismatic value or legal tender status.

Can I include Morgan Silver Bars in my Precious Metals IRA?

Yes, most 1 oz Morgan Silver Bars qualify for inclusion in Precious Metals IRAs because they meet the IRS requirement of .999 fine silver purity. However, you should always confirm with your specific IRA custodian before making a purchase, as some custodians have additional requirements regarding approved mints or bar specifications. The bars must be stored in an approved depository and cannot be held personally while in the IRA.

How are Morgan Silver Bars packaged and shipped?

Individual Morgan Silver Bars are typically packaged in protective plastic flips to prevent scratching and tarnishing during shipping and storage. When ordering 20 or more bars, they often come in tubes or sheets for more efficient storage and handling. Anchor Bullion uses discreet packaging with full insurance coverage, ensuring your silver arrives safely without advertising the valuable contents to potential thieves during transit.

What is the difference between Morgan Silver Bars and Silver Rounds?

The primary difference between Morgan Silver Bars and silver rounds lies in their shape and production method. Silver bars are rectangular with precise edges and typically feature stamped designs, while rounds are circular like coins. Both contain the same amount of silver (1 troy ounce of .999 fine), but bars often stack more efficiently and may carry slightly lower premiums. The Morgan design appears on both formats, but bars are generally preferred by investors focused on maximum silver content per dollar spent.

| Specification | Details |

|---|---|

| Metal Type | Silver |

| Purity/Fineness | .999 (99.9% pure silver) |

| Weight | 1 Troy Ounce (31.1035 grams) |

| Dimensions | Approximately 50mm x 29mm x 2.3mm |

| Obverse Design | Lady Liberty (Morgan Dollar replica) |

| Reverse Design | Varies by mint (typically includes weight and purity) |

| Producing Mints | Golden State Mint, Highland Mint, Silvertowne, others |

| Condition | Brilliant Uncirculated (BU) |

| Face Value | None (bullion bar) |

| IRA Eligibility | Yes - meets .999 purity requirement |

How Morgan Silver Bars Compare to Other Silver Investments

Morgan Silver Bars vs. American Silver Eagles

While American Silver Eagles carry the prestige of U.S. government backing and legal tender status, Morgan Silver Bars offer significantly lower premiums over spot price. Both contain exactly one troy ounce of .999 fine silver, but Eagles typically cost $8-12 more per ounce due to their numismatic appeal and government mintage. For pure silver investment purposes, Morgan bars provide better value, though Eagles may be easier to sell and are more widely recognized globally.

Morgan Silver Bars vs. Generic Silver Rounds

Morgan Silver Bars and generic silver rounds both offer low-premium options for silver stacking, with bars typically carrying marginally lower premiums due to simpler production processes. The rectangular shape of bars allows for more efficient storage in safety deposit boxes and home safes, while rounds may appeal more to collectors who prefer the traditional coin shape. Both are produced by private mints and contain identical silver content, making the choice largely a matter of personal preference and storage considerations.

Morgan Silver Bars vs. 10 oz Silver Bars

Larger format silver bars like 10 oz bars offer even lower premiums per ounce than 1 oz Morgan bars, but sacrifice liquidity and divisibility. The 1 oz size provides maximum flexibility for selling partial holdings or dollar-cost averaging into positions over time. Additionally, 1 oz bars are more affordable for beginning investors and easier to gift or use in barter scenarios, while 10 oz bars are better suited for serious stackers prioritizing the lowest cost per ounce.

Understanding Silver Bar Premiums and Spot Price

The premium on Morgan Silver Bars represents the amount above silver's spot price that buyers pay to acquire physical silver. These premiums cover minting costs, distribution, dealer margins, and market demand factors. Morgan Silver Bars typically carry premiums of just 3-5% over spot during normal market conditions, making them one of the most cost-effective ways to invest in physical silver. Premium levels fluctuate based on market volatility, with higher premiums during periods of strong demand or supply constraints. Savvy investors monitor premium trends and often increase purchases when premiums compress, maximizing the amount of silver acquired per dollar invested.

Silver Bar Authentication and Anti-Counterfeiting Features

Reputable private mints producing Morgan Silver Bars implement various security features to ensure authenticity and prevent counterfeiting. These may include precise weight specifications, crisp edge reeding, deep-struck designs with fine details, and mint-specific hallmarks or serial numbers. When purchasing from established dealers like Anchor Bullion, buyers receive guaranteed authentic products sourced directly from recognized mints. Investors should be wary of deals that seem too good to be true and always purchase from reputable sources. Simple tests like magnetic slides, weight verification, and dimensional checks can help confirm authenticity, though buying from trusted dealers remains the best protection against counterfeits.

Building Your Silver Stack with Morgan Bars

Storage Best Practices

Morgan Silver Bars stack efficiently in tubes of 20 or storage boxes designed for bullion. Keep bars in a cool, dry environment away from chemicals that can cause tarnishing. Many investors use airtight containers with silica gel packets to control humidity. For larger holdings, consider a home safe rated for precious metals storage or a bank safety deposit box.

Dollar-Cost Averaging Strategy

The uniform 1 oz size of Morgan Silver Bars makes them ideal for dollar-cost averaging strategies. By purchasing a consistent number of bars monthly or quarterly, investors smooth out price volatility and build positions systematically over time. This approach reduces the risk of buying at market peaks while ensuring steady accumulation regardless of short-term price movements.

Exit Strategy Considerations

The standardized weight and widely recognized Morgan design ensure strong liquidity when it's time to sell. Local coin shops, online dealers, and private buyers all readily purchase 1 oz silver bars. Having bars from recognized mints in common weights simplifies the selling process and typically results in better buyback prices compared to odd-weight or obscure bars.

Authenticity Guaranteed

Every Morgan Silver Bar is sourced directly from established private mints and verified for weight and purity.

Secure Shipping

All orders ship fully insured in discreet packaging to protect your investment from door to door.

Industry Expertise

Our precious metals specialists help you make informed decisions based on your investment goals.

Disclaimer: The information provided in this article is for general informational and educational purposes only and is not, and should not be construed as, investment, financial, legal, or tax advice. Anchor Bullion LLC is a precious metals dealer and is not a licensed or registered financial advisor, broker-dealer, or financial planner. All investments, including precious metals, involve risk, and the past performance of an asset is not a guarantee of future results. You should conduct your own research and consult with a qualified professional before making any investment decisions. Anchor bullion is not responsible for pricing and/or typographical errors.